Commodities Trading on award-winning platform

Commodities are the fundamental building blocks of the world economy. They’re the physical goods that are used directly by both consumers and industries to produce other consumer goods.

Contact UsCommodities Trading

Commodities are the fundamental building blocks of the world economy. They're the physical goods that are used directly by both consumers and industries to produce other consumer goods.

There are several types of commodities, including:

- Energy

- Precious Metals (gold, silver & copper)

There are several types of commodities, including:

- Supply & demand

- Weather & geographical events

- Economic & political factors

- The value of U.S. dollar

These products tend to be homogeneous in nature and play a fundamental role in the economy. Volatility can often be seen to increase whenever there are disruptions around the globe, such as with social or political unrest, or unusual weather conditions.

Commodities like gold are popular with investors as they have long been considered a store of value and therefore, a “safe haven”. These safe-haven assets have historically held their value during times of economic and political uncertainty.

What is commodities trading?

Commodities trading is a popular way to speculate on the financial markets. The origins of commodities trading can be traced back to Asia hundreds of years ago. Commodities are mostly traded in two forms - cash and forward - with the settlement (or delivery) dates being the main difference between the two. Cash settled commodities have a settlement date that is usually in the near future, while forward commodities usually settle further in the future and therefore, tend to have wider spreads. Find out more about commodities here. The most popularly traded commodity sectors are energies (like oils and natural gas), metals (including gold, silver and copper) and soft commodities (such as cocoa, coffee and sugar and wheat). See how you can start trading commodities with us.

Our Core Values

Enjoy some of the best commodity spreads on the market with no insurance costs, including on gold and oil

As a continuous stream, your profit/loss will be clearer over the position’s lifetime and with a daily funding charge for holding a position overnight, there’s no need to close on expiry and open a new position

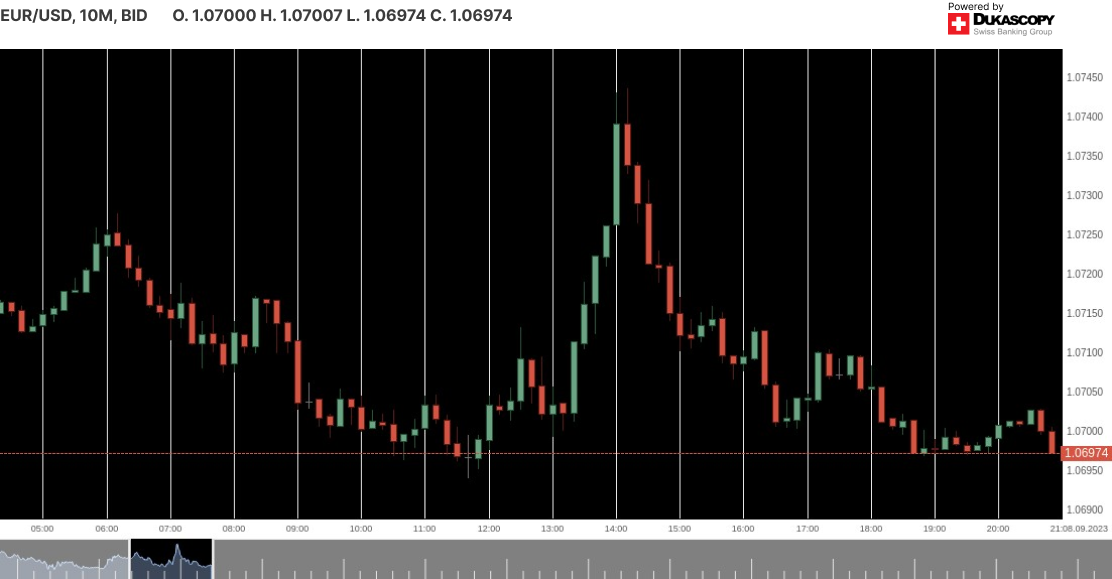

Take advantage of technical analysis, available as long as you want, and backdated price charts for the last three to five years

Why trade commodities with Bank of Bullion ?